Before investing in stocks, it is important to learn how to use stocks properly. This includes learning about the common types of stocks, how to invest in a portfolio, and the tax implications. Creating textbooks can help you make the right decisions and avoid common pitfalls. You can also use message boards to promote specific stocks. People who promote thinly traded stocks often dump them once the price starts to rise. This strategy is often attributed to gullibility.

Investing Basics

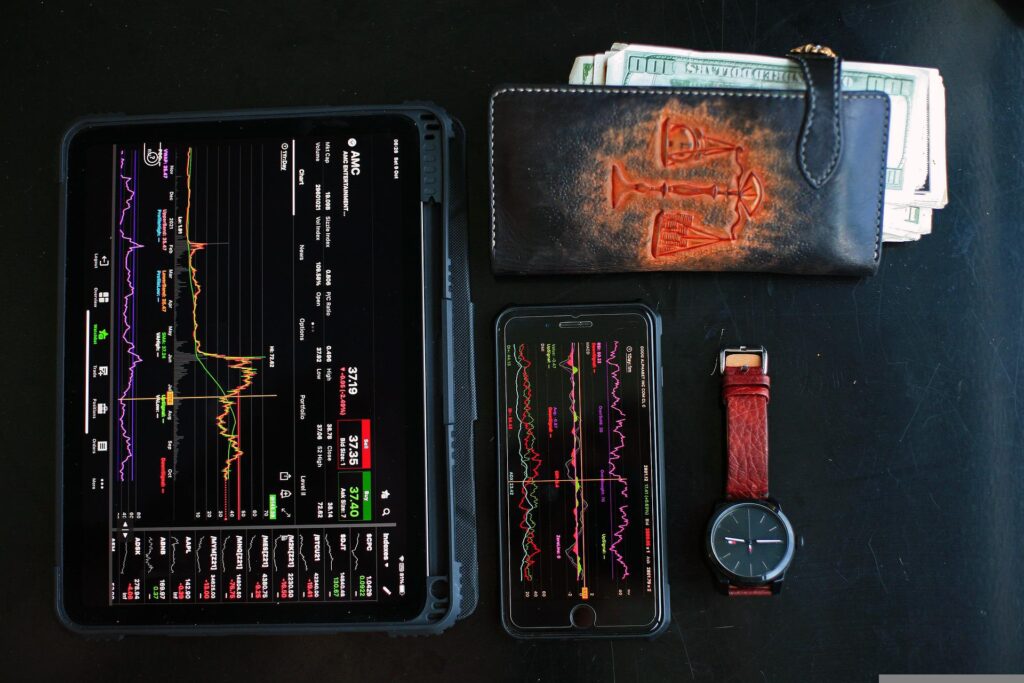

If you are new to investing, the financial markets can be intimidating. There are many options and risks, and many people are unsure about where to invest their money. But by understanding the basics, you can minimize those risks and maximize your returns. This article covers the basics of investing in stocks, including what you can invest in and how to do it.

When you start investing in stocks, it’s best to invest in smaller companies. You pay less capital gains tax when you invest your money in small businesses. You can also speak to an investment firm or financial advisor to help you choose the right investments for your goals. Invest today with Tesler app that will help you make profits daily.

Common stock types

Before investing in any particular type of stock, you should first determine your investment goals and risk tolerance. There are two types of stocks: common stocks and preferred stocks. Both types of shares have their advantages and disadvantages. You should also consider the time frame you have to invest, and whether you’re using the money for retirement or other long-term goals.

Dividend stocks are also known as income stocks. These types of stocks pay dividends to investors and are usually safe bets for conservative investors. They are popular with retirees and people looking for a steady income. Unlike growth stocks, income stocks are less volatile and generally carry less risk.

In stocks

Investing in stocks is a way to make money. A share represents ownership in a company and can pay dividends to shareholders. The value of a stock fluctuates based on supply and demand. These fluctuations are due to many factors, including economics, politics, and energy costs. There are pros and cons to investing in stocks, and it’s best to do your research before investing.

Successful investors are usually the best informed. They are also willing to share their experiences with others. It’s a good idea to follow investors on social media and listen to their tips. The advice they give can be invaluable, but it’s important to remember that the advice they give should be taken with a grain of salt and backed up with your own research.

Tax implications of investing in shares

The tax implications of investing in stocks vary depending on the status of your tax return and the amount of your adjusted gross income. Capital gains tax rates typically range from 0% to 20% and are higher for individuals with AGI over $41, $676, and $83,350. However, there are many strategies you can use to minimize your capital gains tax.

One strategy is to diversify your portfolio between tax-exempt, tax-advantaged, and fully taxable investments. This can help you minimize your tax burden by keeping in mind the characteristics of each investment.

With a pension account in shares

invest When investing with a retirement savings account, you should consider your time horizon. The longer you save, the higher the percentage of your money you can invest in stocks. Investing too conservatively can limit your potential growth. However, you should also consider your risk appetite and financial circumstances.

One of the best retirement account options is a traditional IRA. These accounts are tax-advantaged and make it easier to invest in stocks. The disadvantage of these accounts is that you cannot withdraw the money until you are older. However, these accounts are great ways to start building your retirement nest egg. There are two main types of IRAs: traditional and Roth. You can also find special retirement accounts for small business owners or the self-employed.

Investing in stocks with a self-managed plan

Self-managed investing is a good option for people with knowledge and time to invest. But before investing, you should open an account with a broker. You can also consider setting up a cash cushion in your account. This is how you protect yourself from early payments and bridge stock market fluctuations.